About

David Nelson, CFA

Chief Strategist Belpointe - Talking Head covering markets, stocks & politics. A career that took me from Rock to Stocks gives me a different perspective.

+ FOLLOW THIS TUMBLRIBM - Will Buffett Get His Wish?

In his 2011 letter to shareholders Warren Buffett is on record saying “We should wish for IBM’s stock price to languish throughout the (next) five years.”

He’s of course pointing to the fact that if buybacks continue at their present pace his percentage of the share base will grow over time. After listening to last night’s conference call I think Warren is going to get his wish.

The Elephant in the Room

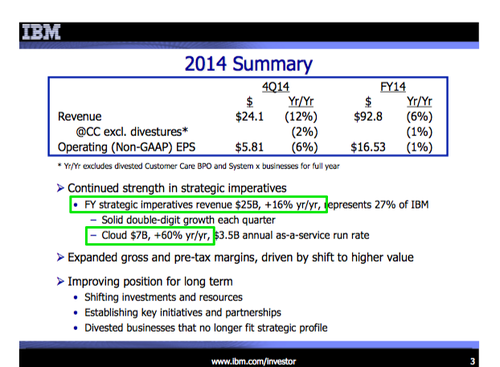

After the close IBM reported another disappointing quarter giving downbeat guidance. Revenue missed slightly coming in at $24.1 Billion but headline EPS of $5.81 beat the street consensus of $5.43. After the report I told CNBC host Kelly Evans “the initial positive move in the stock may be just a vote from shareholders that analysts had cut too far.” The elephant in the room is that just 6 months ago the estimate was $6.80, 17% higher than last night’s report.

The tone of the conference call during the Q&A was cordial but you could hear the concern coming from many analysts. I did a quick count reading through the transcript and found the phrase “was down” appeared 19 times when referring to revenue, profits and growth and that was before it crossed over to the Q & A.

Below is just a few examples:

Our pre-tax income was down 19%, and net income down 22%…

We generated free cash flow of $600 million, which was down $1.1 billion year-to-year…

In Asia-Pacific, revenue was down 6%.

The growth markets were down 5%

Our revenue in China was down 20%.

We ended the quarter with a cash balance of $9.7 billion, which was down $1.4 billion…

The slide show confirmed much of last month’s article IBM - The Emperor has no clothes.

Strategic Initiatives

Every cloud has its silver lining and IBM has theirs. Management finally gets they have a problem but they still need to let go of financial engineering gimmicks to keep floating eps and its shares. The massive buybacks are no longer working.

Several times throughout the call management referred to strategic initiatives and the slide provided is encouraging.

Cloud is growing hand over fist but at $7 Billion it’s not enough to move the needle. In total the strategic initiatives management refers to are $25 Billion. Placed against an $86 Billion anticipated revenue for 2015 these initiatives have a long way to go, perhaps 5 years or more to return the company to growth.

What Should They Do?

I’m not sure large acquisitions is the way to go but I wouldn’t be opposed to smaller ones. The problem is that even if they make the right moves it won’t change the time frame for success. For example one name that has been floated is Cyber Security Firm FireEye (FEYE) but with estimated revenue of $621 Million next year, it’s not enough. IBM could cross sell and put all their resources behind the enterprise but again it will take time.

What to Do with the Stock

Shorting the stock here is probably not a great call. The sentiment in the name is abysmal and there’s always the activist waiting in the wings. Bulls have to ask themselves how much do I pay for little or no growth over the next couple of years. If it’s 10x earnings that gets you to about 160 off of a $16 estimate. If it’s 8, well you can do the math.

Before we can see multiple expansion the strategic initiative management refers to is going to have to get a lot larger or activists will have to step in and restore investor confidence. At this point neither option is enough for me so I remain on the sidelines.

The most important line from Buffet’s letter was the following. “In the end, the success of our IBM investment will be determined primarily by its future earnings.”

Amen.

firstadopter liked this

eightfatswine liked this

theretailtrader liked this

fordandmessere-blog liked this

yahoofinancecontributors2 reblogged this from davidnelsoncfa

financecontributors-blog liked this

financecontributors-blog reblogged this from davidnelsoncfa

davidnelsoncfa posted this